If Your Employer Pays for Your Parking, Where Does It Go on the Tax Forms

UPDATE:

On December 20, 2019, the President signed into law the Taxpayer Certainty and Disaster Tax Relief Act of 2019 as part of the Further Consolidated Appropriations Act, 2020. This act includes the long-awaited repeal of the employer-provided parking tax. The Tax Cuts and Jobs Act of 2017 (TCJA) added a new Internal Revenue Code Section 512(a)(7), which required tax-exempt entities to add the cost of employer-provided parking to unrelated business income (UBI). Fortunately, the recent act eliminated Section 512(a)(7) entirely, which means that the cost of employer-provided parking is no longer considered UBI, retroactive to the initial date of enactment of the TCJA. Many tax-exempt entities previously filed Form 990-T, Exempt Organization Business Income Tax Return, to report UBI for employer-provided parking for fiscal years 2018 and 2019. Affected tax-exempt entities may now file amended Forms 990-T for any year in which they reported employer-provided parking UBI. Even if the entity did not pay income tax due to net operating losses (NOL), the entity should file the amended Form 990-T to recover the portion of the NOL utilized to offset the employer-provided parking UBI. In addition, entities that paid income tax should file amended Forms 990-T to recover the taxes paid on employer-provided parking UBI.

Original article:

The Internal Revenue Service (IRS) recently issued Notice 2018-99, providing interim guidance on Qualified Transportation Fringes (QTF), one of which is employer-provided parking. The Tax Cuts and Jobs Act (TCJA), signed into law in late 2017, included a provision that tax-exempt organizations must increase unrelated business income (UBI) by the amount of certain QTFs. The law did not provide explanations as to how a tax-exempt organization should quantify the employer-provided parking QTF. However, Notice 2018-99, issued December 10, 2018, supplies information to help tax-exempt organizations calculate the dollar amount of the QTF that must be added to UBI.

What Is Employer-Provided Parking?

Employee parking has not previously been a benefit taxable to employees, and parking expenses were deductible for the employer. Among the changes effected by the TCJA, for-profit employers may no longer deduct employer-provided parking expenses. In an attempt at parity, the TCJA also requires not-for-profit entities exempt from income taxation to report the cost of employer-provided parking as UBI, and pay federal income tax as appropriate. The rationale is: since for-profit entities are not allowed a deduction against income for the parking QTF, they ultimately pay more tax; therefore, to level the playing field, the tax-exempt entity should also pay tax on the parking QTF. Fortunately, employer-provided parking remains non-taxable to the employees of both for-profit and tax-exempt entities.

The broad definition of employer-provided parking includes:

- Parking garages.

- Parking structures.

- Paved parking lots.

- Unpaved parking lots.

- Any area specifically set aside for the sole purpose of parking vehicles.

Parking is generally on, or near, an employer's business premises and is owned or leased by that employer. However, parking may also be at a location owned by another entity that the employer pays so that employees may park on the premises.

Until the IRS issues regulations on employer-provided parking, a taxpayer is permitted to use "any reasonable method" to calculate the cost of the parking QTF. However, Notice 2018-99 did explicitly clarify two things:

- Depreciation related to parking facilities is not included in the cost of employer-provided parking.

- A taxpayer may not use the value of parking in lieu of the cost of parking as a reasonable method.

Item one is good news because many parking facilities are capitalized and depreciate over time. The expense related to depreciation is not reportable in UBI as a QTF; therefore, the actual cost of the parking facility is not included in UBI.

Item two is not as favorable because many entities believe the value of parking is zero, since when free parking is provided to anyone in the community, it also includes employees. Notice 2018-99 specifically states that an employer is not permitted to take the position that there is no parking UBI because the economic value to the employee is zero. However, per the allowable calculation method described later, a taxpayer may potentially escape UBI using another reasonable method.

Acceptable Methods for Calculating Parking QTF UBI

Notice 2018-99 outlines two methods by which an entity may quantify the cost of employer-provided parking and classify the proper amount considered UBI. These methods are specifically identified as allowed but they are not necessarily required, so long as a taxpayer can show that a reasonable method has been utilized.

The first method applies when a taxpayer pays a third party for employee parking spots. This is easily quantifiable: the 2018 limit for employer-made payments to an outside party for employee parking is $260 per month per employee. This amount is not includable in employees' wages and is not taxable to the employee. As a result, this amount is also not deductible against employer income. Following the aforementioned parity logic of the TCJA, this same amount is includable as UBI for tax-exempt entities. Note, however, that only the actual cost paid up to $260 is reported as UBI. Any amount in excess of $260 per month is included in an employee's wages and is not subject to employer UBI.

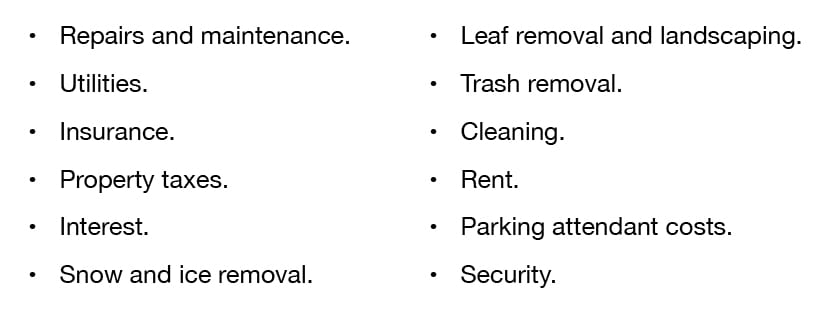

The second method is more complex. This method applies when an employer owns or leases the parking structure or site and incurs parking costs, which include but are not limited to:

The next step is to determine the total number of available parking spots and how many of those spaces are reserved as employee-only—e.g., signage indicates only employees may park in those spots, or a keycard is required to enter a closed-access area. Additionally, an employer should determine if there are other parking spots reserved for non-employees, such as spots specifically reserved for customers or patients. Similar to employee-reserved parking spots, this could be denoted by signage stating only customers may park in those particular areas.

Once reserved and non-reserved parking spots are counted, an employer should then calculate the ratio of employee-reserved parking spaces to all available parking spaces. This percentage should be multiplied by the total parking costs, and the result equals an employer's UBI.

It is important to note that the above calculation only applies to areas specifically reserved for employees. If an employer provides general parking to both employees and the public, with no spots reserved for specific use, then an employer should also do an analysis to determine what proportion of spots are used by employees during normal business hours. If the parking spots used by employees (but not exclusively reserved for employees) comprise less than 50% of all of the parking available, then an employer may conclude that the primary use of the parking area is for public use and not for employee parking.In this highly favorable position, none of the employer parking costs are subject to UBI.

If the employee parking spots constitute greater than 50% of the total parking spots, then some or all of the employer parking costs will be subject to UBI. First, the percentage of the non-employee reserved spots (such as customer-only spots) to the total parking spaces should be applied to the total parking costs. That proportional amount is not subject to UBI because those expenses specifically apply to reserved non-employee parking. This step only applies when an organization actually maintains designated reserved parking spaces.

The parking expenses not subject to UBI should then be subtracted from the total parking expenses. The remaining balance represents the costs allocated to parking spaces not reserved for a specific use (such as employee-only or customer-only parking); a reasonable method should be used to allocate the amount that applies to employee parking versus the amount that applies to public parking. The expenses allocated to employee parking under the reasonable method are then subject to UBI, when concluded to represent greater than 50% of all non-reserved spaces. Notice 2018-99 offers several examples with calculations that demonstrate the application of these steps. It does not, however, provide an example of a calculation to allocate parking UBI under a reasonable method.

The IRS Provides Some Relief to Affected Taxpayers

The IRS recognizes that this guidance has been issued almost a full year after the enactment of the TCJA, and many taxpayers may have already filed tax returns for periods that are subject to the parking QTF rules (the new parking law applies to parking costs incurred after December 31, 2017). Therefore, the IRS is allowing some relief to affected taxpayers. First, taxpayers filing an income tax return, such as Form 990-T, for the first time as a result of UBI generated from employer-provided parking may be relieved of interest and penalties accrued for underpayment of employer-provided parking UBI tax.

Second, the IRS allows taxpayers until March 31, 2019, to change their parking policies, and to make the changes retroactive to January 1, 2018. For tax-exempt entities, such as hospitals, with both public and employee parking, this is an excellent opportunity to change reserved parking rules. If an entity is able to reallocate parking spots such that it may successfully determine that the parking spaces are primarily for public use, then an entity may be relieved from reporting some or all of the parking expenses as UBI.

Though Notice 2018-99 provides some guidance, there are still ambiguities that will hopefully be addressed soon with proposed IRS regulations. In the interim, it is important that all entities—both for-profit and tax-exempt—consider the use of parking spots provided for employees and others. This review should be undertaken well ahead of the March 31, 2019 deadline.

If you would like more information about how the new parking QTF rules affect your organization or would like assistance in any matter related to tax planning, compliance, or business advisory, contact one of our PYA executives below at (800) 270-9629

© 2019 PYA

No portion of this article may be used or duplicated by any person or entity for any purpose without the express written permission of PYA.

If Your Employer Pays for Your Parking, Where Does It Go on the Tax Forms

Source: https://www.pyapc.com/insights/employer-provided-parking-when-expenses-become-income-for-tax-exempt-entities/

0 Response to "If Your Employer Pays for Your Parking, Where Does It Go on the Tax Forms"

Post a Comment